hawaii federal tax id number search

Number Continue as instructed above. Hawaii like most other states requires most of its businesses to obtain a specific state tax ID number.

Hawaii Rental Application Template Rental Application Hawaii Rentals Rental

The Legislature also authorized county governments.

. So if you apply for a Hawaii tax ID number with us whether it is a state Hawaii tax ID number or you are applying for a Hawaii tax ID number click here to select state first. HONOLULU AIEA 96701 on this site. You can find an irs Hawaii tax ID number with a Hawaii tax ID number search but obtain a Hawaii tax ID number you need to click in this link.

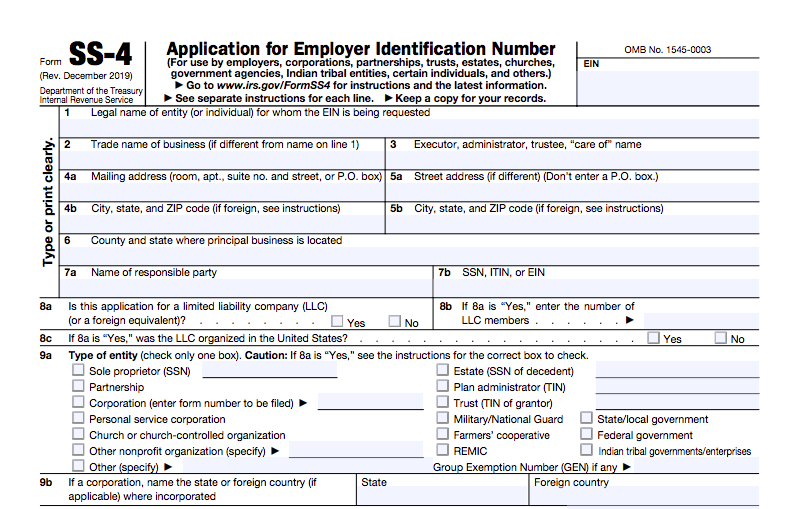

Employers Quarterly Federal Tax Return Form W-2. Federal Employer Identification Number is 99-0189021. Then there is a Federal Tax ID Number a Business Tax Registration Number and a Social Security Number for your personal income tax.

UHMCC does not have a state tax ID number. Search for a Business Name in th Hawaii LLC Hawaii Trademark Tax Id Number. How to get a Federal Tax Id Number.

Its the unique identification number assigned to each Hawaii tax account. Individuals can register online to receive their ID by filing Form BB-1 through Hawaii Business Express. Not just the pages but even the text within all the Microsoft Word Excel and.

Hawaii State Website. To learn more about Hawaii Tax ID. Search with Google This custom search allows you to search the entire Department of Taxations Website.

A Hawaii federal tax id number is also called an IRS number. This is a general business tax number also called a tax id or home occupation permit that all businesess must obtain. After submitting the registration of your Hawaii Tax ID.

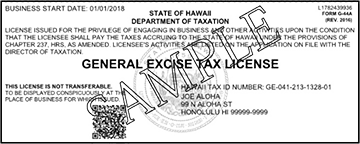

Its also called an employer identification. If you are ready to begin the application for a Hawaii Tax Identification Number select the entity that corresponds to your business type or the legal structure of your entity. The GE account type stands for General ExciseUse and County Surcharge Tax.

The Department of Taxation is moving to a new integrated tax. Start your Hawaii Tax ID EIN Application. GE-999-999-9999-01 All sales tax related account IDs begin with the letter GE to reflect the tax type.

UHMCC ID 5398156 Labels for Education. You should not enroll in AutoFile using a Hawaii Tax ID that begin with abbreviations for other tax types such as CO. Therefore the last four-digits of the specific tax account number issued by DOTAX are used on the billing notices rather than the last four digits of your Social Security.

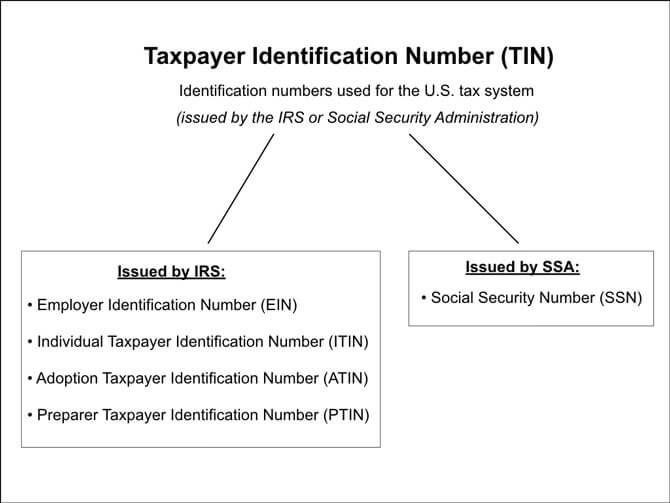

Request for Taxpayer Identification Number TIN and Certification Form 4506-T. Once your application has been submitted our agents will begin on your behalf to file your application and obtain your Hawaii Tax ID. 3 rows Hawaii Tax ID Number Changes.

After your Tax ID is obtained it will be sent to you via e-mail and will be available for immediate use. To learn more about the differences between the GET and sales tax please see Tax Facts 37-1 General Excise Tax GET. Obtain your Tax ID in Hawaii by selecting the appropriate entity or business type from the list below.

Hawaiʻi Tax Online is the convenient and secure way to get a State Tax Identification Number BB-1 file tax returns make payments manage your accounts and conduct other common transactions online with the Hawaiʻi Department of Taxation. Search with Google Department of Taxation. Opening a business in Hawaii means taking the opportunity to invest in a unique economy with strong international ties and a vibrant base for tourism.

The Hawaii Tax ID starts with a two-letter account type identifier followed by 12 digits. As part of the registration process you add your Hawaii Tax ID. Employers engaged in a trade or business who pay compensation Form 9465.

Request for Transcript of Tax Return. Your federal tax ID number is sometimes referred to simply as a tax ID. A Hawaii State tax ID Number can be one of Two State Tax ID Numbers.

University of Hawaii at Mānoa Childrens Center. Hawaii SalesTax IDs that are issued after the modernization project begin with the letters GE and are followed by 12 digits. You can get a tax ID in.

Hawaii Administrative Rules section 18-231-3-1417 enables the Department of Taxation Department to revoke tax licenses due to abandonment. Employees Withholding Certificate Form 941. Use your federal tax ID number to provide your employers with it and also to file your own taxes.

Council on Revenues Agenda Monday May 23 2022 200 PM. See a full list of all available functions on the site. Be prepared when it comes to your taxes with the right federal tax ID number for the job.

THERE ARE TWO STATE TAX IDS. The Hawaii State UI Division tax withholding ID is 093-185-7408-01. Once your application has been submitted choose the delivery timeframe you desire and.

For more information go to the IRS website at. And IF you sell or buy wholesale retail a n Sales Tax ID Number Sellers Permit Wholesale License Resale State ID 2. A sellers permit also called a sales tax ID or a state employer number ID for employee tax withholding.

The tax rate is 015 for Insurance Commission 05 for Wholesaling Manufacturing Producing Wholesale Services and Use Tax on Imports For Resale and 4 for all others. Home Up Search for a Business Name in th Hawaii LLC Hawaii. Number button then select the Hawaii Tax ID.

You can start your business and get a tax ID in AIEA cost to start is about 10817 or could start with 106677 that depends on your budget. Hawaii Federal Tax Id Number Search. Hawaii salestax ids that are issued after the modernization project begin with the letters ge and are followed by 12 digits.

Welcome to the Online Assistant to Apply for a Hawaii Tax ID EIN Number. Free File is made possible through a public-private partnership between the IRS and commercial tax software companies. Scholastic Reading Club UHMCC ID H44ZK.

Number in the select the Hawaii Tax ID. Due to the confidentiality of Social Security numbers DOTAX issues a specific tax account number for each taxpayer that does not have a Federal Identification number. This number is distinct from your federal tax ID number and its important to realize the purpose of each.

The UHMCC federal tax number is 99-6000354. Please select the Hawaii Tax ID.

Currently Non Collectible Status Cnc Hilo Hi 96720 Www Mmfinancial Org Irs Irs Taxes Status

Minnesota Department Of Revenue Minneapolis Mn Mm Financial Consulting Minneapolis Lettering Letter I

Currently Non Collectible Status Cnc Ny Ny 10035 Www Mmfinancial Org Irs Taxes Internal Revenue Service Irs

Irs Installment Agreement Wheatfield In Mm Financial Consulting Inc Irs Payment Plan How To Plan Business Plan Template Free

3 11 13 Employment Tax Returns Internal Revenue Service

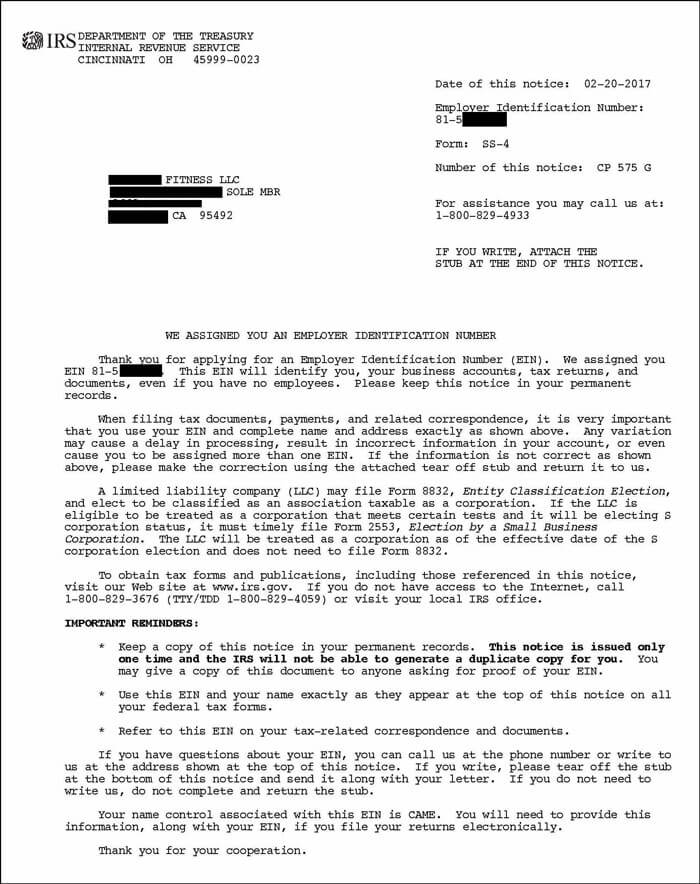

Understanding The Employer Identification Number Ein Lookup

How To Look Up A Colorado Account Number Can Department Of Revenue Taxation

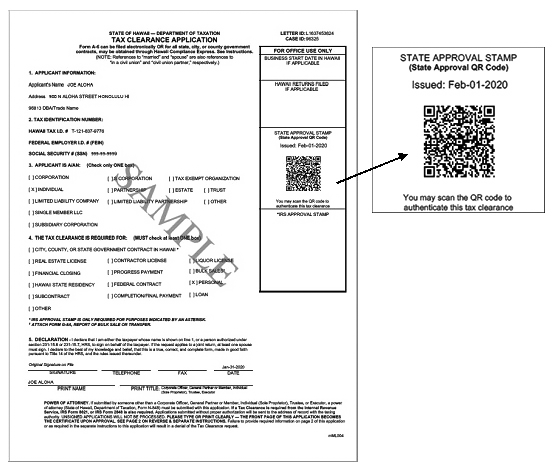

Tax Clearance Certificates Department Of Taxation

How To Look Up A Colorado Account Number Can Department Of Revenue Taxation

How To Look Up A Colorado Account Number Can Department Of Revenue Taxation

Get Ahead Of The Tax Filing Game In 2022 Filing Taxes Tax Deadline Credit Consolidation

Understanding The Employer Identification Number Ein Lookup

Irs Installment Agreement Franklin Park Il 60131 Mm Financial Consulting Inc Irs Taxes Payroll Taxes Internal Revenue Service

View Print 1098 T Tax Form And Information All Campuses Myuh Services

/1099g-b89de84cce054844bd168c32209412a0.jpg)

Form 1099 G Certain Government Payments Definition

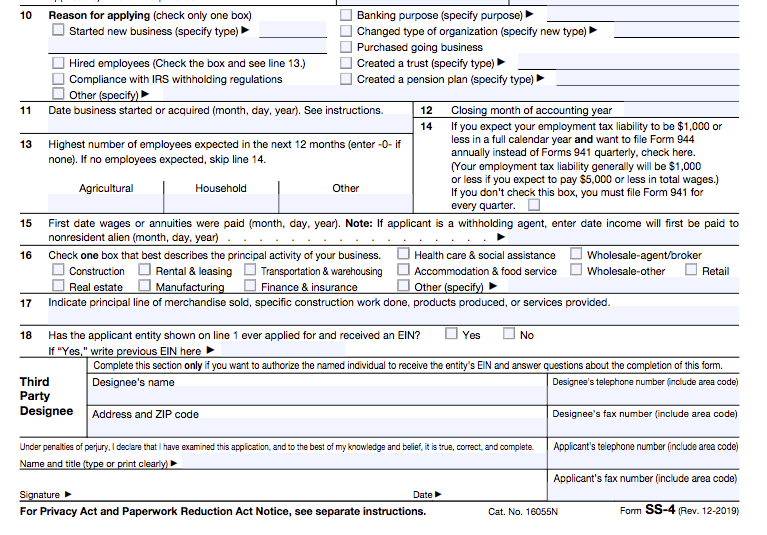

How To Get An Ein For Llc Online 2022 Guide Llc University